The chart below is a net difference between the bull and bears using the Investors Intelligence survey as the benchmark. Investors Intelligence is my favorite survey, not just because they are one of the pioneers, but also the fact that their index seems very hard to move in one direction or the other. Therefore, when you do finally see an extreme on this index it has extremely high odds of telling you exactly what either bullish or bearish sentiment has the true hold on the market. If we are bullish and looking for a bottom, then we are looking for a large amount of bearish sentiment and this is exactly what we have here.

Keep in mind that the rally we will see should be nothing more than a bear market rally, but DO NOT underestimate the power of bear market rallies. They tend to offer some of the strongest returns in a brief amount of time. This is one of the reasons that we will be bumping our allocation up in the coming days as we get more confirmation of a major low being put in place.

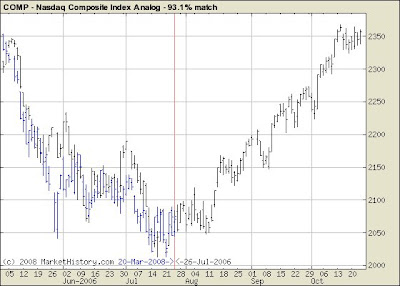

The Predictive model for the NASDAQ continues to show some moderate rally in stock prices over the next 7-10 days, followed after a brief pull back by a potentially lethal rally. I don't typically like to look anymore than 2 weeks out, but we cannot ignore this model as it has been very accurate and it tells us that the major low has been put into place.

The Predictive model for the NASDAQ continues to show some moderate rally in stock prices over the next 7-10 days, followed after a brief pull back by a potentially lethal rally. I don't typically like to look anymore than 2 weeks out, but we cannot ignore this model as it has been very accurate and it tells us that the major low has been put into place.The M.O. model is also in very sold territory and has traveled far enough from its lows to confirm an intermediate term buy signal. This remains very bullish and at extremes such as this the M.O. is very accurate.

Our old Sentiment Friend the 3 line break has also confirmed an intermediate term low and actually has added some extra strength to its signal with a bullish divergence, much the way many of the models have been doing. This model also remains a big plus.

Our old Sentiment Friend the 3 line break has also confirmed an intermediate term low and actually has added some extra strength to its signal with a bullish divergence, much the way many of the models have been doing. This model also remains a big plus.

While we have gotten full confirmation that a Bear Market has indeed begun, we can take some solace in a couple of things.

While we have gotten full confirmation that a Bear Market has indeed begun, we can take some solace in a couple of things.

Our old Sentiment Friend the 3 line break has also confirmed an intermediate term low and actually has added some extra strength to its signal with a bullish divergence, much the way many of the models have been doing. This model also remains a big plus.

Our old Sentiment Friend the 3 line break has also confirmed an intermediate term low and actually has added some extra strength to its signal with a bullish divergence, much the way many of the models have been doing. This model also remains a big plus. While we have gotten full confirmation that a Bear Market has indeed begun, we can take some solace in a couple of things.

While we have gotten full confirmation that a Bear Market has indeed begun, we can take some solace in a couple of things.1. We had a very bearish allocation to equities of only 50% to 60% and thus it has taken a considerable amount of sting out of this decline already.

2. We are getting very strong indications that the market has reached a point of major support and a potentially very strong rally is on the way. This is a plus in a couple of ways. It will afford us with some very nice short term trading opportunities and also, it will allow those who remain heavily allocated to equities of say 80% to 100% the chance to either lighten up on these positions or begin to hedge their equities for the next leg down.

Of course I will keep close tabs on the market to make sure that indeed the coming rally is a bear market rally or not. Because as we all know, with the financial markets, anything can happen and probably will. It is just up to us to try and find an edge of sorts and exploit that edge.

I wish all of you a great Easter Holiday and I will be back in the trenches bright and early Monday Morning.

1 comment:

Nice blog you have here thanks for sharing this

Post a Comment