Equity Markets - While at this time last week I had thought the equity market would begin its intermediate term correction last week, the S&P 500 could only muster a little more than a 0.63% gain on the week. This small gain coupled with intraday volatility has helped to give more confirmation to the theory that the equity markets are in a transition short term from up to down. Weekly sentiment readings show only about 4% bearish on Friday which translates into an environment for a decline. It is important to remember that this decline will be nothing more than a correction from the March Lows.

Support Levels for the S&P 500 -

1st - 1419

Support Levels for the S&P 500 -

1st - 1419

2nd - 1408

Last - 1398

10 Year Note - There simply are too many conflicting signals in the credit markets. The intermediate term model is suggesting that rates will continue to go up and bond prices will go down. The Short term model is telling me that there has been a short term top in rates and they should start to work lower. No clear cut signal, so in doubt stay out!

Corn - Corn prices look like they want to continue their short term rally. This should only be a rally in a bear market for corn, but prices do look to move higher.

Cocoa - After 4 days of indecisive action, cocoa looks to move lower once again. The potential for a small crash in prices is very possible.

Sugar #11 - I have been talking for a bit about the potential of Sugar getting into a position to have a strong rally. I will be posting a chart and commentary on Sugar in the next couple of days. It is very close to a major low if not already there. Keep an eye on it.

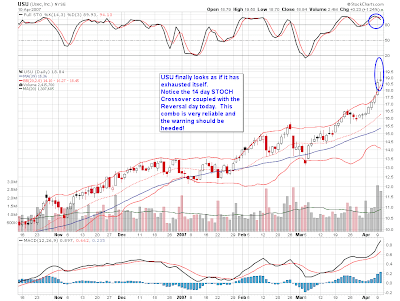

USEC Corp. - I had been looking for USU to pullback with the market in order to add more to the core position. The stock continues to exhibit exceptional strength and Monday it should have yet another stellar day. Although I had expected a small decline I certainly am not complaining.

BDAY - Continues to look poised for a decline to the 7 1/4 to 7 1/8 area before resuming its rally.

DF - Dean Foods, after a very nice rally from the Three White Soldiers is starting to look a bit fatigued here. A pullback to 32 1/4 would not be out of the question.

DVSA - Much like BDAY and DF a pullback seems to be in the cards. Look for strong support at 7 3/8.

GM - Currently making a coil or triangle as some would call it, so the short term direction will be based upon the completion of this pattern and which way it wants to break. Intermediate term I am still very bullish on GM especially after the double bottom at $29.