If you are not familiar with

CandleStick charting there is a multitude of free resources available on the

Internet to enlighten you. These charts have been around for quite some time and have become very popular, almost to popular.

While the effectiveness of

CandleStick patterns has eroded because of such wide spread use, they still remain a valuable tool in our pursuit of trend changes or trading patterns. There are a great many patterns that steal the spotlight and are used quite regularly by many investors. Morning Star, Evening Star,

Doji, Bullish and Bearish Engulfing, Piercing Line, Dark Cloud Cover, the list goes a little further than that, but you get the picture.

There is however a

CandleStick pattern that seems to be the red headed stepchild of the family and quite honestly I do not see why that is the case. I have used this pattern over and over and over with great results and it continues to do well in the current market

environment. Like anything else, it will not work all the time, but with a few rules put in place along with the pattern it offers great results.

OK, enough of my

rambling. The

CandleStick pattern I am talking about if the Three White Soldiers.

Typically this pattern is an intermediate term buy signal that tells us the trend has changed from down to up. There are some qualifications however.

- Works Best On Stocks Selling Over $5 per Share

- Based Upon Volume Analysis, Sometimes the Stock Price Will Test the Lows Before a Major Move Begins

- This Larger the Bars are In the Pattern, Typically Indicates How Strong the Move Will Be

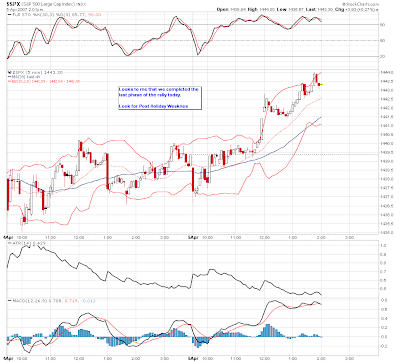

- Now here is a very important key to this pattern and something you need to burn into your brain.... AFTER THE PATTERN FORMS, IF PRICE MOVES BACK TO THE HALFWAY POINT OF THE BODY IN THE SECOND CANDLE AND FINDS SUPPORT THEN YOU HAVE A POTENTIAL BARN BURNER ON YOUR HANDS.I have attached a couple of charts here to get you familiar with the pattern and show you the 50% rule I just spoke of. I will be posting more charts on this pattern, including some that will show what happens when the pattern goes astray. Like I said, It does not work all the time.

We will also follow a few stocks in real time with this pattern and see what comes of it. We will use the pattern along with some technical indicators to tell us the whole story.

For now though study the charts and surf the net for candlestick web sites and learn. You can even go to

http://www.stockcharts.com/ and do a market scan for the THREE WHITE SOLDIERS pattern.

I realize that I did not finish the moving average modules, but I thought I should give that concept a break so you could fully absorb what had been talked about already. I will cover the other moving average uses in the not to distant future.