The first purchase of options on the blog and it should be a good one.

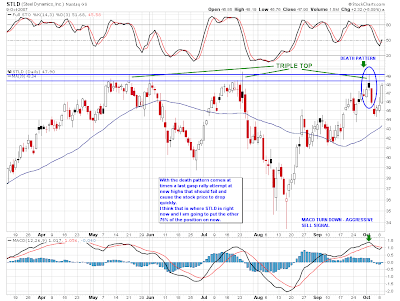

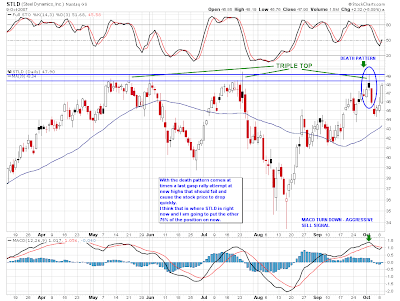

After the Death Pattern on STLD, I placed 25% of my option position into play.

I was saving the other 75% allocation for an event such as we have now.

There are times with a death pattern that the stock will try one more run at new highs and it should fail. After this failure the stock will typically have a fairly sharp decline.

I will be purchasing the November 50 Puts at 3.90/4.10

This will put us better than 2 points in the money and enough time to capitalize on a decline.

Upon being filled on the order, I will place a 33% stop loss order on the options in case the stock wants to continue to rally.

Remember that there is significant risk with options trading, but there is also some very significant profit potential as well.