I realize that I have not done an educational module in quite some time and it is time to get back on track with it. I am going to start completely over, so there may be some repetition for long time readers.

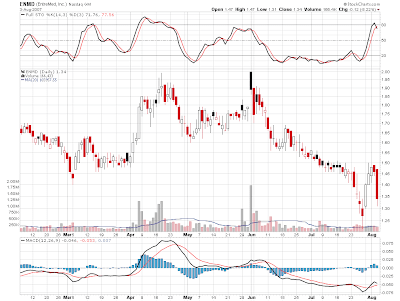

The first module is going to cover Candlestick patterns that are very reliable of which there are only 3. The first is the Three White Soldiers pattern as shown below. We will follow these pattern selections in real time and learn from them as they develop before our very eyes.

You can see from the chart, what it is that makes up the pattern. It is a multi day pattern (3 days) and is one of the most reliable, especially after an extensive decline.

The ideal purchase point for traders is the middle of the second candle of the pattern.

Position traders can begin their accumulation at the onset of the pattern with a 25% allocation of the full position you wish to carry.