It just might be as evident by what the smart and dumb money have been doing.

The smart money has been dumping all the cocoa they can get their hands on. (BLUE LINE)

While the not to swift small speculators have been more than willing to buy. (RED LINE)

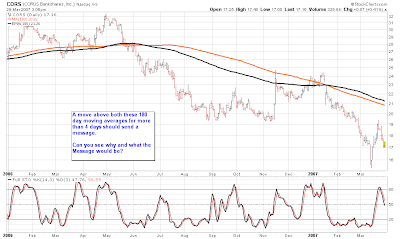

A quick look at the chart below will show you what happens when the smart and dumb money get into these positions. THE PRICE COLLAPSES!!

Now while it has been a near vertical rally I certainly am no fool and I would not sell short outright into such a strong rally. Maybe shorting as the price begins to decline would be a more prudent course. Take a Look and tell me what you think.

P.S. I almost have the commodity blog up and running, about 2 more weeks and it should be a go. This way I can have this blog for equities and the other for Futures.

As usual, have a great weekend!!