With all the talk of the 1987 all over again and the

perma bears coming out of the woodwork preaching their doom and gloom of the most recent mortgage problems, I thought it fitting to show some very strong evidence as to why we will NOT go into a bear market and quite the contrary should have a great rally.

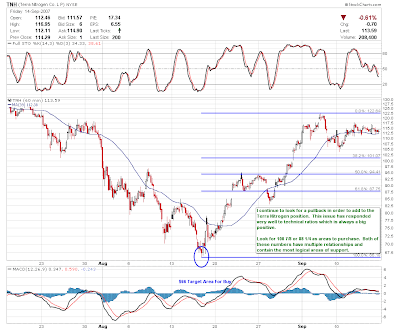

The chart below is of the Commercial Traders (Blue Line) and you can clearly see they are very heavy buyers and have been very heavy buyers. This is the smart money that is in the know months before anything hits the press and the public reacts. You can bet your bottom dollar if they thought this problem would snowball into a potential financial collapse then they would not be such heavy buyers.

The action of the Commercial Traders is very bullish for equities.

The Green Line below is the Commodity Fund Traders who typically ride the major trend until its extinction. The Fund Traders are wrong about 90% of the time at major turning points in the markets. As you can see, they have been very strong sellers, which is also very bullish for stocks.

The combination of the Commercials being such heavy purchasers of equities and the Fund Traders being such heavy sellers points to one inescapable fact. Equities will not enter into a bear market and should over the next 12-18 months have an incredible run in prices.