I just wanted to send a quick note along to everybody that have subscribed to this blog.

First of all, Thanks Very Much for your confidence and support. If you know of anyone

else that might find this information of use please feel free to send them on over.

Secondly to those who have yet to confirm their subscription.

Once you have entered your email address into the feedburner link you will

get an email to that address asking you to confirm this subscription.

You Must Respond To This Email In Order To Stay On The List.

Thirdly, I just wanted everybody to know that I will never violate your right to privacy

by selling or lending any of the emails that are on the subscription list.

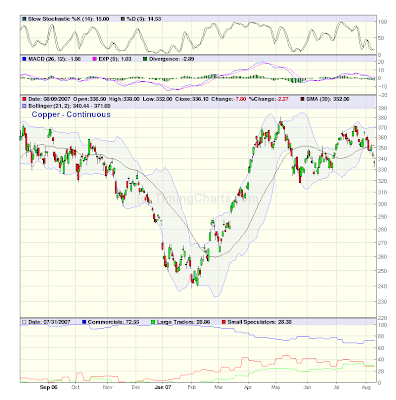

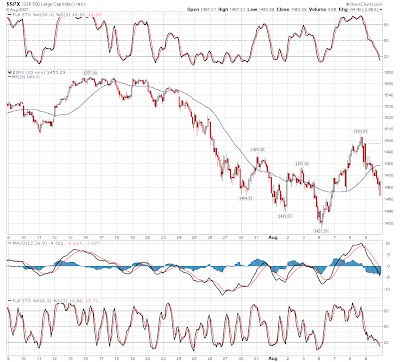

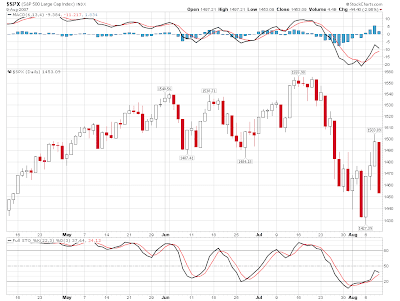

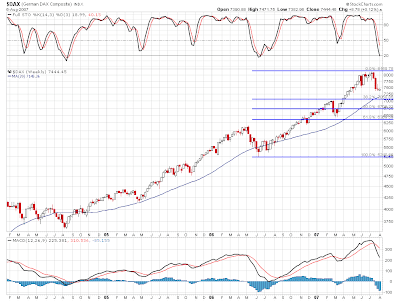

I hope all of you had a great weekend and lets get ready for what should prove to be a very

interesting week in the markets!