Corn remains in a bear market.Shorting all strength continues to be the best action. Copper remains in a secular bull market and needs to complete its current pullback beforethe purchase can be exercised.

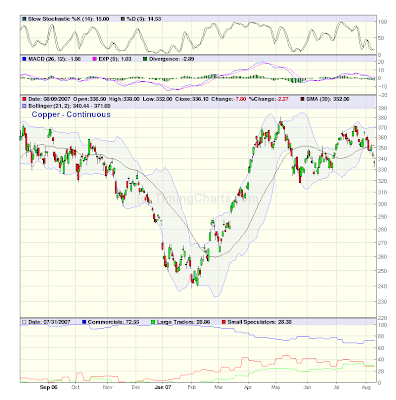

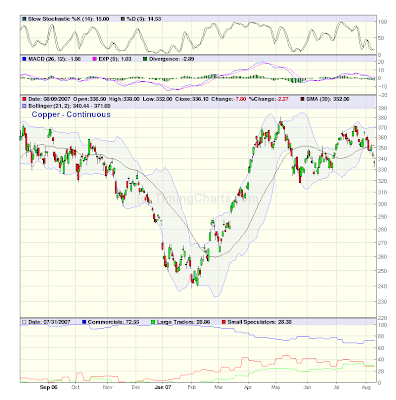

Copper remains in a secular bull market and needs to complete its current pullback beforethe purchase can be exercised.

I

continue to look for cotton to have one more move to a new high above 63.When 63 or above is obtained it should be set up for a short sale.

Sugar is getting quite close to its area of purchase.

Sugar is getting quite close to its area of purchase.Keep close tabs on this one as it has some serious upside potential.

Lumber has not broken down and that is a good thing. While the advance has and continues to take a while to get going, I still remain bullish.

Lumber has not broken down and that is a good thing. While the advance has and continues to take a while to get going, I still remain bullish.

A close below 265 will cause me some concern, but right now all systems look go!

Copper remains in a secular bull market and needs to complete its current pullback before

Copper remains in a secular bull market and needs to complete its current pullback before

No comments:

Post a Comment