Module #1 and Module #2 covered the basics for Simple Moving Averages. This module is going to cover the same material, except we are going to use Exponential Moving Averages as opposed to Simple.

An Exponential Moving Average differs from the simple only by the way it is computed mathematically. Whereas, a Simple Moving Average gives each data point in its series an equal weighting, the exponential applies more weight to current data in the string as opposed to older data. In other words, if you have a 10 day Exp. Moving Average, the most current data is going to have more effect on the average than say the data point from 7 days ago. The basic theory behind this is simply that more recent price action has more relevance to the trend then does older data. To be honest with you, I am still a little up in the air about the validity of this concept. Therefore, the majority of my work utilizes Simple Moving Averages. Feel free to experiment with the two different types of moving averages and find the calculation you find most useful to your style of investing.

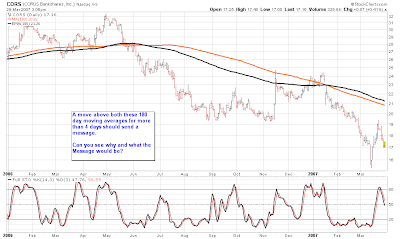

I am going to attach charts that will use the Exponential Moving Average for you to see just how they flow. I will use the same time frames and same stocks that I did with the module on Simple Moving Averages just so you can make the comparison.

An Exponential Moving Average differs from the simple only by the way it is computed mathematically. Whereas, a Simple Moving Average gives each data point in its series an equal weighting, the exponential applies more weight to current data in the string as opposed to older data. In other words, if you have a 10 day Exp. Moving Average, the most current data is going to have more effect on the average than say the data point from 7 days ago. The basic theory behind this is simply that more recent price action has more relevance to the trend then does older data. To be honest with you, I am still a little up in the air about the validity of this concept. Therefore, the majority of my work utilizes Simple Moving Averages. Feel free to experiment with the two different types of moving averages and find the calculation you find most useful to your style of investing.

I am going to attach charts that will use the Exponential Moving Average for you to see just how they flow. I will use the same time frames and same stocks that I did with the module on Simple Moving Averages just so you can make the comparison.

No comments:

Post a Comment